What You Should Know When to File Taxes in Thailand Part I 你應該知道在泰國報稅的時間 Part I

- Admin

- Aug 30, 2021

- 2 min read

When living in a country, it is important to know when to pay your taxes to avoid being fined. In Thailand, you should be aware of some deadlines for paying taxes and forms when reporting taxes. Details are as follows:

當你住在一個國家的時候,知道當地報稅時間是件重要的事情,避免被罰款。當你住在泰國的時候,應該知道報稅的期限以及應使用的報稅表格。詳細細節如下:

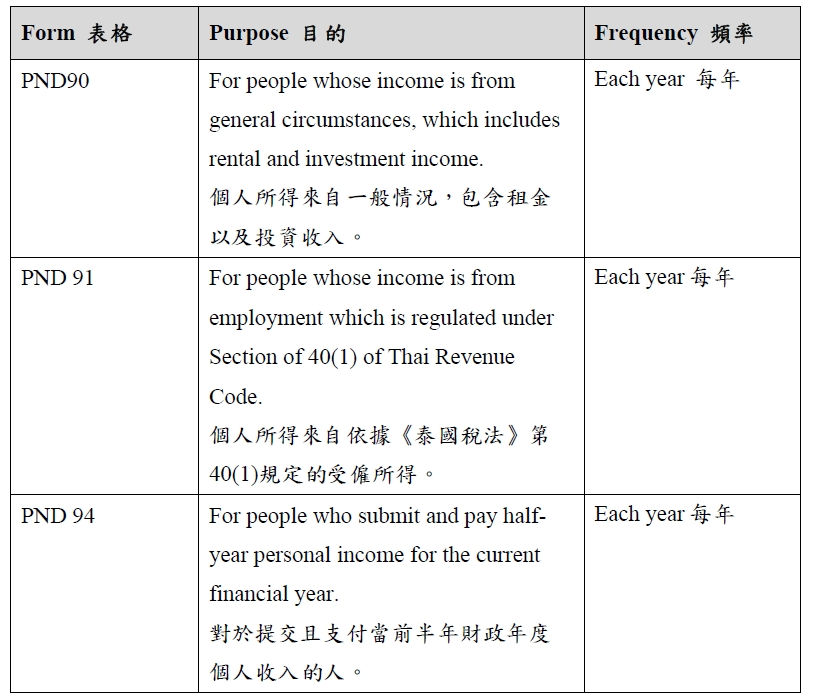

A. Personal Income Tax 個人所得稅

For every resident or non-resident who works or runs a business in Thailand, he/she is subject to personal income tax for the income earned in Thailand. “Resident” means any person residing in Thailand for more than 180 days; a non-resident is, however, subject to tax only on income sourced in Thailand. Person income tax must be filed by March 31 each year, there are several applicable forms listed below.

不管是否為泰國居民,只要在泰國工作或做生意都需要繳納個人所得稅。居民指在任一稅收年度在泰國居留超過180天,如果其國外的收入於同稅收年度帶入泰國,也須繳納所得稅。非居民只需針對泰國收入繳稅。個人所得稅需在每年3月31日申報,以下為幾種申報表格。

If you want to know more detail of personal income tax, please refer to our article “Personal Income Tax in Thailand” at https://0rz.tw/sAHLM.

如想知道個人所得稅進一步資訊,請參考我們先前的文章”泰國個人所得稅”在https://0rz.tw/sAHLM。

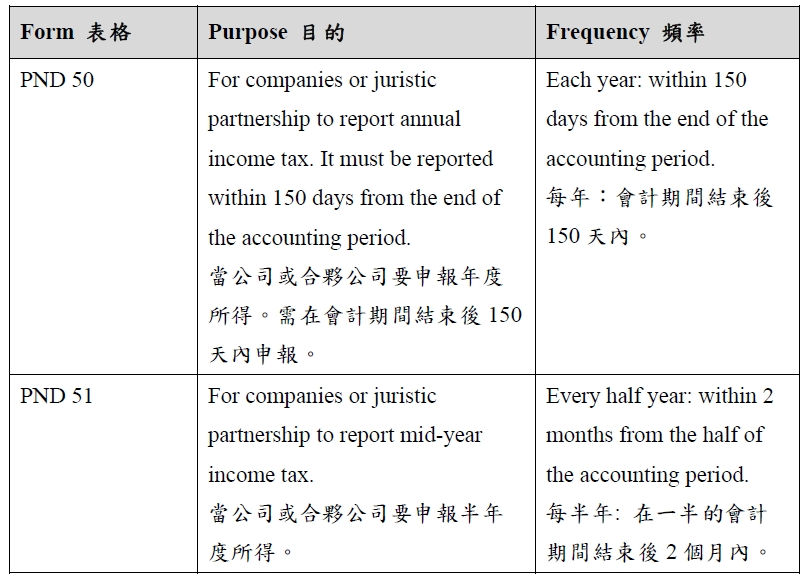

B. Corporate Income Tax 企業所得稅

Corporate income tax is imposed by Thai companies and partnership carrying on business in Thailand or foreign companies and partnerships not carrying on business in Thailand but deriving certain types of income from Thailand. There are 2 applicable forms:

企業所得稅的課徵對象為在泰國營業的公司及合夥公司以及部分收入來自泰國的國外公司及合夥公司。有兩種申報表格:

If you want to know more detail of corporate income tax, please refer to our article “Taxes in Thailand” at https://0rz.tw/OYIAh.

如想知道企業所得稅進一步資訊,請參考我們先前的文章”泰國稅法”在https://0rz.tw/OYIAh。

因本文篇幅較長,故分成兩個部分,本次為Part 1, Part 2敬請期待。

#filetaxinthailand #泰國報稅 #thaipersonalincometax #泰國個人所得稅 #thaiemployee #泰國企業 #泰國企業所得稅 #thaicorporateincometax #泰國稅法 #thaitaxlaw #投資泰國 #investinthailand #IBCFirm #ThaiLawFirm #泰國報稅時間 #reporttaxinthailand #ThaiAccountingFirm #ThaiAuditFirm #泰國中文律師 #IBC法律金融會計事務所 #泰國律師 #泰國法律事務所 #泰國會計 #泰國審計 #泰國會計事務所 #泰國審計事務所 #法律顧問 #會計顧問

Comments